Voices

Find our thought leadership, announcements, Founder Stories, Industry Reports, Investment Insights, and more

From Power Law to Proprietary Insight: Unlocking Early-Stage Alpha, Data-Driven VC, and Building a Next-Gen Firm

From Power Law to Proprietary Insight: Unlocking Early-Stage Alpha, Data-Driven VC, and Building a Next-Gen Firm

Thought Leadership

June 30, 2025

Team of Female Founders is Overhauling AI Protection

Team of Female Founders is Overhauling AI Protection

Portfolio News

February 25, 2025

Setpoint raises $30M from Citi and Wells Fargo

Setpoint raises $30M from Citi and Wells Fargo

Portfolio News

August 15, 2024

10 Years On, 645 Ventures Is Using Software To Improve Its Odds At Seed

10 Years On, 645 Ventures Is Using Software To Improve Its Odds At Seed

Team

July 3, 2024

GSK, Moderna, Novartis and more join Slope in new biospecimen consortium

GSK, Moderna, Novartis and more join Slope in new biospecimen consortium

Portfolio News

June 25, 2024

True Anomaly Secures $1.6M Space Force Contract

True Anomaly Secures $1.6M Space Force Contract

Portfolio News

June 6, 2024

Overtime named Time Magazine’s 100 Most Influential Companies for ‘24

Overtime named Time Magazine’s 100 Most Influential Companies for ‘24

Portfolio News

May 31, 2024

Firestorm announces $12.5M in seed funding

Firestorm announces $12.5M in seed funding

Portfolio News

March 21, 2024

Shift5 Named to World’s Most Innovative Companies

Shift5 Named to World’s Most Innovative Companies

Portfolio News

March 19, 2024

Ashley and Resident Announce Acquisition

Ashley and Resident Announce Acquisition

Portfolio News

March 3, 2024

Inside Gen-Z sports brand Overtime's road to $100 million in revenue and how it plans to build on the momentum

Inside Gen-Z sports brand Overtime's road to $100 million in revenue and how it plans to build on the momentum

Portfolio News

February 22, 2024

Setpoint Approved by S&P Global Ratings as Third-Party Due Diligence Firm

Setpoint Approved by S&P Global Ratings as Third-Party Due Diligence Firm

Portfolio News

February 9, 2024

True Anomaly’s first Jackal AOVs ready for launch at Vandenberg Space Force Base

True Anomaly’s first Jackal AOVs ready for launch at Vandenberg Space Force Base

Portfolio News

February 8, 2024

Startup That Monitors Space Threats Raises $100 Million to Expand Satellites

Startup That Monitors Space Threats Raises $100 Million to Expand Satellites

Portfolio News

December 12, 2023

Nearmap announces acquisition of Betterview

Nearmap announces acquisition of Betterview

Portfolio News

December 8, 2023

Overtime Select announced as new league for elite high school girls basketball

Overtime Select announced as new league for elite high school girls basketball

Portfolio News

October 23, 2023

Real estate media software platform Aryeo joins Zillow

Real estate media software platform Aryeo joins Zillow

Portfolio News

August 2, 2023

Cisco acquires venture-backed identity security startup Oort

Cisco acquires venture-backed identity security startup Oort

Portfolio News

July 13, 2023

Exclusive: Defense contractor Shift5 closes $83M Series B round

Exclusive: Defense contractor Shift5 closes $83M Series B round

Portfolio News

June 7, 2023

645 Partner: Nnamdi Okike selected for the 2023 Midas Brink List

645 Partner: Nnamdi Okike selected for the 2023 Midas Brink List

Team

May 4, 2023

AaDya Security Announces Series A Funding

AaDya Security Announces Series A Funding

Portfolio News

April 25, 2023

A16Z leads $43M Series A for Setpoint

A16Z leads $43M Series A for Setpoint

Portfolio News

December 7, 2022

645 Raises $347M Fund IV and Select Fund I: Doubles Down on Seed and Series A Investments

645 Raises $347M Fund IV and Select Fund I: Doubles Down on Seed and Series A Investments

Team

December 1, 2022

Security deposit: $17M to bolster RentSpree's leasing solutions

Security deposit: $17M to bolster RentSpree's leasing solutions

Portfolio News

August 26, 2022

Overtime Sports Raises $100 Million to Expand Leagues

Overtime Sports Raises $100 Million to Expand Leagues

Portfolio News

August 9, 2022

FiscalNote Celebrates Public Company Debut

FiscalNote Celebrates Public Company Debut

Portfolio News

August 4, 2022

Crypto Risk Monitoring Firm Solidus Labs Raises $45M

Crypto Risk Monitoring Firm Solidus Labs Raises $45M

Portfolio News

May 13, 2022

Welcoming Randi Jakubowitz to the 645 Ventures’ Success Team

Welcoming Randi Jakubowitz to the 645 Ventures’ Success Team

Team

May 4, 2022

Mandolin named the most innovative music company of 2022

Mandolin named the most innovative music company of 2022

Portfolio News

March 8, 2022

Welcome Justin Fargione to 645 Ventures’ Engineering Team

Welcome Justin Fargione to 645 Ventures’ Engineering Team

Team

March 1, 2022

Nnamdi Okike joins Yahoo Finance to discuss tech investing, SPACs, Web3, and the metaverse.

Nnamdi Okike joins Yahoo Finance to discuss tech investing, SPACs, Web3, and the metaverse.

Thought Leadership

February 23, 2022

The case for BYOD (Bring-your-own-data) applications/w=1920,quality=90,fit=scale-down)

/w=1920,quality=90,fit=scale-down)

The case for BYOD (Bring-your-own-data) applications

Thought Leadership

February 8, 2022

Shift5 raises $50M to defend transport networks from cyberattacks

Shift5 raises $50M to defend transport networks from cyberattacks

Portfolio News

February 8, 2022

Shift5 raises $50M Series B led by Insight

Shift5 raises $50M Series B led by Insight

Portfolio News

February 8, 2022

Panther Labs raises fresh funds at $1.4B valuation

Panther Labs raises fresh funds at $1.4B valuation

Portfolio News

December 2, 2021

Embedded Fintech: A How-To Guide for Software Founders Seeking to Launch Financial Products

Embedded Fintech: A How-To Guide for Software Founders Seeking to Launch Financial Products

Thought Leadership

November 17, 2021

What’s Next for Product-Led Growth? Customer-Led Growth

What’s Next for Product-Led Growth? Customer-Led Growth

Thought Leadership

November 10, 2021

Solidus Labs rakes in another $15 million

Solidus Labs rakes in another $15 million

Portfolio News

November 9, 2021

Goldbelly is Launching a TV Channel

Goldbelly is Launching a TV Channel

Portfolio News

November 9, 2021

FiscalNote Strikes $1.3 Billion SPAC Deal

FiscalNote Strikes $1.3 Billion SPAC Deal

Portfolio News

November 8, 2021

Mandolin To Live Stream From Pitchfork Music Festival’s London Debut

Mandolin To Live Stream From Pitchfork Music Festival’s London Debut

Portfolio News

November 3, 2021

Squire is proving barbershops are big business

Squire is proving barbershops are big business

Portfolio News

November 3, 2021

How a lawyer and a finance guy ditched the rat race

How a lawyer and a finance guy ditched the rat race

Portfolio News

October 29, 2021

This startups solves the managment of shipments

This startups solves the managment of shipments

Portfolio News

October 26, 2021

Bespoke Post Raises $40 Million Series B

Bespoke Post Raises $40 Million Series B

Portfolio News

October 26, 2021

Driving Your Product Roadmap: Key Learnings from Kevin Mattice (CPO, Cherre)

Driving Your Product Roadmap: Key Learnings from Kevin Mattice (CPO, Cherre)

SaaS Founders at Work

October 8, 2021

Slope Raises $20M in Series A Funding

Slope Raises $20M in Series A Funding

Portfolio News

October 6, 2021

The Rise of Crypto Infrastructure Software: 645 Ventures’ Investment in Solidus Labs

The Rise of Crypto Infrastructure Software: 645 Ventures’ Investment in Solidus Labs

Thought Leadership

October 1, 2021

Bigeye, closes second round this year with $45M

Bigeye, closes second round this year with $45M

Portfolio News

September 23, 2021

Genially raises $20M Series B to help make education interactive

Genially raises $20M Series B to help make education interactive

Portfolio News

September 22, 2021

Welcome Jon Smith to 645 Ventures' Investment and Research Team

Welcome Jon Smith to 645 Ventures' Investment and Research Team

Team

August 23, 2021

Aaron Holiday (GP & Co-Founder) is nominated to the Midas Brink List

Aaron Holiday (GP & Co-Founder) is nominated to the Midas Brink List

Team

August 13, 2021

Squire triples its valuation (again) with Tiger Global

Squire triples its valuation (again) with Tiger Global

Portfolio News

July 28, 2021

Transforming software testing from a bottleneck to an enabler: our investment in Launchable

Transforming software testing from a bottleneck to an enabler: our investment in Launchable

Thought Leadership

July 27, 2021

RentSpree Raises $8 Million in Series A

RentSpree Raises $8 Million in Series A

Portfolio News

July 21, 2021

Apty Raises $7.5M in Series A Funding

Apty Raises $7.5M in Series A Funding

Portfolio News

July 13, 2021

Concert livestreaming platform Mandolin raises $12M

Concert livestreaming platform Mandolin raises $12M

Portfolio News

June 30, 2021

Multichannel marketing platform Iterable raises $200M

Multichannel marketing platform Iterable raises $200M

Portfolio News

June 15, 2021

Goldbelly snags $100M after seeing 300% growth in 2020

Goldbelly snags $100M after seeing 300% growth in 2020

Portfolio News

May 19, 2021

A $100 Million Bet on Cross-Country Restaurant Delivery

A $100 Million Bet on Cross-Country Restaurant Delivery

Portfolio News

May 17, 2021

Overtime Raises $80 Million From Jeff Bezos, Drake, NBA Stars and Others

Overtime Raises $80 Million From Jeff Bezos, Drake, NBA Stars and Others

Portfolio News

April 22, 2021

Restaurants Tire of Forking Over Delivery-App Fees

Restaurants Tire of Forking Over Delivery-App Fees

Portfolio News

April 12, 2021

Welcoming Lexi Quirk to the 645 Ventures Success Team

Welcoming Lexi Quirk to the 645 Ventures Success Team

Team

March 9, 2021

Scaling Your Enterprise Team with Yotam Yemini

Scaling Your Enterprise Team with Yotam Yemini

SaaS Founders at Work

March 8, 2021

645 Taking Action To Help Combat Racially Motivated Hate Crimes & Misogyny

645 Taking Action To Help Combat Racially Motivated Hate Crimes & Misogyny

Thought Leadership

March 3, 2021

Panther named #4 on EnterpriseTech30’s startup list

Panther named #4 on EnterpriseTech30’s startup list

Portfolio News

February 24, 2021

Nanit raises another $25M for its AI-powered baby monitor

Nanit raises another $25M for its AI-powered baby monitor

Portfolio News

February 22, 2021

This Startup Raised $60 Million To Bring Concierge Medicine To Employees

This Startup Raised $60 Million To Bring Concierge Medicine To Employees

Portfolio News

February 18, 2021

Building a B2B Marketing Operation: Key Learning from Asaph Schulman

Building a B2B Marketing Operation: Key Learning from Asaph Schulman

SaaS Founders at Work

January 29, 2021

Building on a Technology Theme Across Multiple Successful Startups

Building on a Technology Theme Across Multiple Successful Startups

SaaS Founders at Work

January 28, 2021

Resident wins sales, profitability, and $130M in new funding

Resident wins sales, profitability, and $130M in new funding

Portfolio News

January 7, 2021

Squire triples its valuation to $250M in latest round

Squire triples its valuation to $250M in latest round

Portfolio News

December 9, 2020

The Commoditization of Business Intelligence Tools, the Rise of "Embedded Intelligence," and Our Investment in Cube Dev

The Commoditization of Business Intelligence Tools, the Rise of "Embedded Intelligence," and Our Investment in Cube Dev

Thought Leadership

December 9, 2020

FiscalNote raises $160M to fund expansion

FiscalNote raises $160M to fund expansion

Portfolio News

December 4, 2020

The Evolution of Adobe and Future of Creative Software

The Evolution of Adobe and Future of Creative Software

Thought Leadership

October 28, 2020

Announcing Two New Members to the Cornell Tech Council

Announcing Two New Members to the Cornell Tech Council

Team

October 8, 2020

645 Ventures Closes $160 million Fund III & Announces Connected Network

645 Ventures Closes $160 million Fund III & Announces Connected Network

Team

October 8, 2020

GitHub at scale and how to help "Stadium" model maintainers

GitHub at scale and how to help "Stadium" model maintainers

Thought Leadership

September 9, 2020

Eden Health raises $25M to expand real estate partnerships

Eden Health raises $25M to expand real estate partnerships

Portfolio News

August 12, 2020

Static code analysis tools, the future of code reviews, and our investment in DeepSource

Static code analysis tools, the future of code reviews, and our investment in DeepSource

Thought Leadership

July 16, 2020

Welcome Vardan Gattani to 645 Ventures’ Investment & Research Team

Welcome Vardan Gattani to 645 Ventures’ Investment & Research Team

Team

July 8, 2020

645 Ventures Speaks to This Moment in Time: Our Long-term Plan to Combat Systemic Racism

645 Ventures Speaks to This Moment in Time: Our Long-term Plan to Combat Systemic Racism

Thought Leadership

July 6, 2020

DeepSource announces $2.6M Seed round

DeepSource announces $2.6M Seed round

Portfolio News

June 16, 2020

The “Billion-Dollar MBA”: Charting the Paths of MBAs Who Build the Most Successful Technology Startups

The “Billion-Dollar MBA”: Charting the Paths of MBAs Who Build the Most Successful Technology Startups

Thought Leadership

June 5, 2020

InsurTech startup Betterview closes $7.5M funding round

InsurTech startup Betterview closes $7.5M funding round

Portfolio News

June 4, 2020

Lunchbox Raises $2M to Simplify Omnichannel Ordering

Lunchbox Raises $2M to Simplify Omnichannel Ordering

Portfolio News

February 26, 2020

Negotiatus raises $10M to optimize procurement

Negotiatus raises $10M to optimize procurement

Portfolio News

February 13, 2020

Resident sees $12.5M in new funding

Resident sees $12.5M in new funding

Portfolio News

February 6, 2020

The Top Five Myths About Building Billion-Dollar Startups

The Top Five Myths About Building Billion-Dollar Startups

Thought Leadership

January 7, 2020

Betterview inks three-year deal with Nationwide

Betterview inks three-year deal with Nationwide

Portfolio News

November 11, 2019

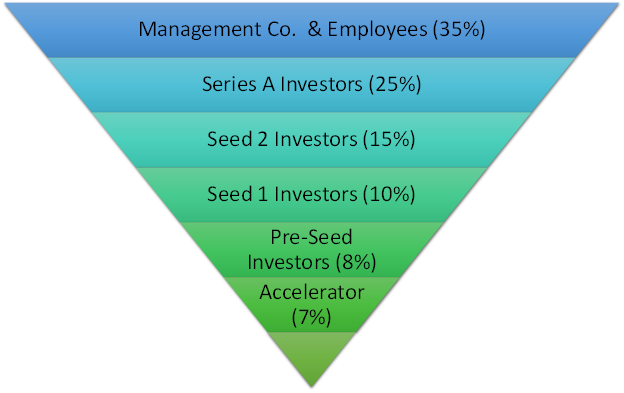

Avoiding Unnecessary Founder Dilution & Staying Out of Cap Table Trouble

Avoiding Unnecessary Founder Dilution & Staying Out of Cap Table Trouble

Thought Leadership

October 30, 2019

Surviving a Coming Storm: Explaining the Unique Factors Driving a Tech Market Correction, and How Technology Founders and Investors Can Persevere Through It

Surviving a Coming Storm: Explaining the Unique Factors Driving a Tech Market Correction, and How Technology Founders and Investors Can Persevere Through It

Thought Leadership

October 10, 2019

Why machine learning falls short in early stage venture capital

Why machine learning falls short in early stage venture capital

Thought Leadership

August 27, 2019

Why Betterview Got Out of the Drone Business

Why Betterview Got Out of the Drone Business

Portfolio News

August 9, 2019

Welcome Meha Patel to 645 Ventures’ Investment & Research Team

Welcome Meha Patel to 645 Ventures’ Investment & Research Team

Team

August 6, 2019

Betterview rakes in $4.5m in fresh funding

Betterview rakes in $4.5m in fresh funding

Portfolio News

May 29, 2019

Princeton Looks to Break Up the White Male Money Monopoly

Princeton Looks to Break Up the White Male Money Monopoly

Team

May 9, 2019

3 Things Founders & VCs Should Know About Building Billion-Dollar Startups During Market Uncertainty

3 Things Founders & VCs Should Know About Building Billion-Dollar Startups During Market Uncertainty

Thought Leadership

March 6, 2019

Nanit named one of Fast Company's "Most Innovative Companies" for 2019

Nanit named one of Fast Company's "Most Innovative Companies" for 2019

Portfolio News

February 20, 2019

Overtime Raises $23M Series B from a16z

Overtime Raises $23M Series B from a16z

Portfolio News

February 14, 2019

Building Ad-Tech Companies that Reach Massive Scale

Building Ad-Tech Companies that Reach Massive Scale

SaaS Founders at Work

January 28, 2019

Consumers 3.0 & The Engagement Economy

Consumers 3.0 & The Engagement Economy

Thought Leadership

January 17, 2019

Circle of Competence and the Venture Capital Investment Triangle

Circle of Competence and the Venture Capital Investment Triangle

Thought Leadership

October 23, 2018

Creating Your Company’s Unique Sales Acceleration Formula

Creating Your Company’s Unique Sales Acceleration Formula

SaaS Founders at Work

October 10, 2017

Launching and Successfully Scaling a Vertical SaaS Company

Launching and Successfully Scaling a Vertical SaaS Company

SaaS Founders at Work

September 20, 2017

Building Enterprise Software Companies that Reach Large Exit

Building Enterprise Software Companies that Reach Large Exit

SaaS Founders at Work

August 27, 2017

Iterable Raises $23 Million Series B

Iterable Raises $23 Million Series B

Portfolio News

December 12, 2016

Setting The Right Valuation For A Competitive Series A Round

Setting The Right Valuation For A Competitive Series A Round

Thought Leadership

July 15, 2015

Software And Data Are Disrupting Venture Capital Firms

Software And Data Are Disrupting Venture Capital Firms

Thought Leadership

February 24, 2015

/w=1920,quality=90,fit=scale-down)

/w=1920,quality=90,fit=scale-down)